Understanding tax day the history and purpose of windows, understanding tax day the history and purpose of osha, understanding tax day the history and purpose of circumcision, understanding tax day the history and purpose of the dnp, understanding tax day the history and philosophy, understanding tax day the history and process, understanding tax day the history of soccer, understanding tax day the history of money, understanding tax day themed, understanding tax returns for dummies, understanding tax withholdings on paycheck, understanding tax write offs,

Taxation has been a consistently hotly debated topic in the United States, ever since its inception as a nation. Many Americans view it as a necessary evil, while others feel burdened by it. Whatever your opinion may be, there is no denying that taxation has played a significant role throughout America's history. Let's take a look at some interesting facts about the history of taxation in the United States.

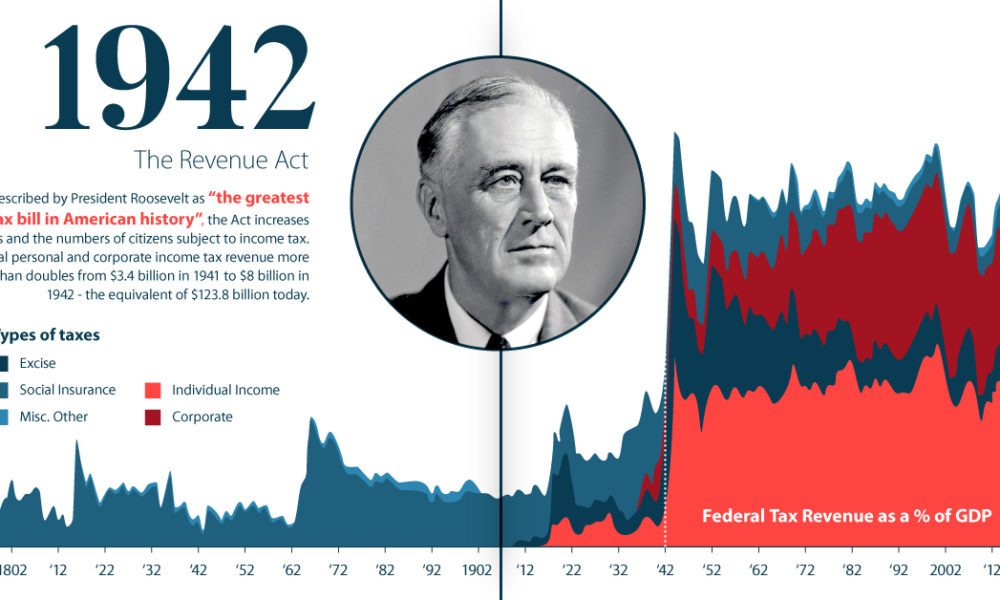

Infographic A History of Revolution in U.S. Taxation

The above infographic gives us a visual representation of the various revolutions that have taken place in U.S. taxation throughout history. From the Revolutionary War to the Tea Party Movement, taxation has often been a primary source of conflict between the government and its citizens.

Understanding tax and its effect on employee

When it comes to taxation, employees are often impacted just as much as employers. Taxes can affect everything from employee benefits to the amount of money an employee takes home in their paycheck. The above slide gives us a brief overview of how taxes affect employees and what they need to know about taxation as a part of their employment.

Top 10 Tax Laws Throughout History History of taxation

If you want to understand the history and evolution of taxation in the United States, you need to be aware of the most influential tax laws throughout history. The above image breaks down the top 10 tax laws that have significantly impacted taxation in the United States. From the Homestead Act of 1862 to the Affordable Care Act, this list covers it all.

1040,1120,1065 US Tax Form / Taxation Concept Editorial Photography

Filing tax forms can be intimidating, especially for those who are doing so for the first time. The above editorial photography helps to alleviate some of those fears by breaking down what some of the most common tax forms look like.

Introducing Taxation in the Early American Republic – Brewminate A

The introduction of taxation in the early American Republic marked a significant shift in the relationship between the government and the people. Prior to this, taxes were primarily used to fund wars or emergency situations. The above image shows us how taxation was introduced in the early American Republic and how it affected the nation's economy.

In conclusion, while taxes are a necessity to keep a country running, they have always been a point of contention for citizens. From the earliest days of the United States to today, taxes have played a crucial role in shaping the nation's history and will continue to do so in the future.

Understanding Tax Day: The History and Purpose of Taxation in the US

If you are searching about An introduction to employee tax benefits, you've visit to the right web. We have images like Infographic a history of revolution in u.s. taxation, a history of taxation • ebisu publications, understanding tax – lifetime solutions. Here you go:

Top 10 tax laws throughout history history of taxation, understanding your tax bill – coshocton county auditor

An introduction to employee tax benefits. Attain expert help in us taxation. Private site homeschool social studies, infographic, history. Tax history laws throughout taxation. Understanding tax – lifetime solutions. Tax day history musings on the eve of the tax deadline csmonitor.com. Understanding tax and it's effect on employee

Also read:

.Blog Archive

-

▼

2023

(245)

-

▼

April

(59)

- Mlb Opening Day Roster Size

- What Is Indictment Summary

- Mlb Opening Day 2023 Brewers

- Mlb Opening Day En Vivo

- Why Did Mlb Cancel Opening Day

- Mlb Opening Day Date 2023

- Nashville Shooting Waffle House

- Alvin Bragg Wage Theft

- Opening Day Schedule For Mlb

- What Is Investigation Hold

- Opening Day 2023 Mlb Schedule

- Father Damien And The Power Of Compassion: Lessons...

- Mlb Opening Day 2023 Quiz

- What Is Conviction Vacated

- Theological Insights Into Holy Saturday And Its Im...

- Mlb Opening Day Countdown Clock

- What Is Investigation Essay

- Good Friday And The Arts: How Artists Have Depicte...

- What Is Indictment In Dark Souls

- Mlb Opening Day 2023 Logo

- Alvin Bragg Family Photos

- Alvin Bragg Manhattan Da

- Mlb Opening Day White Sox

- What Is Investigation Charges In Hospital

- What Is Indictment In Dark Souls

- Nashville Police Shooting Dollar General

- Mlb Opening Day Cubs 2023

- Mlb Opening Day 2023 Tv

- Mlb Opening Day 2023 Predictions

- Mlb Opening Day Countdown Clock

- Nashville Blooming Festival Shooting

- Mlb Opening Day Lineups 2023

- Understanding Tax Day: The History And Purpose Of ...

- Shooting On West End Nashville Tn

- What Is Conviction In The Bible

- Nashville Shooting Kenny Pipe

- A Day Of Unity: The Origins And Observance Of Mart...

- Mlb Opening Day Nyc

- What Is Indicted Grand Jury

- Mlb Opening Day Games

- Mlb Opening Day Logo 2023

- Easter Sunday And The Church: How Different Denomi...

- Mlb Opening Day By Year

- Mlb Opening Day Espn 2023

- Nashville Shooting Gas Station

- What Is Your Conviction In Life

- What Is Investigation Under Crpc

- Alvin Bragg District Attorney New York

- Mlb Opening Day 2023 Brewers

- Baseball Mlb Opening Day

- What Is Quantitative Investigation

- What Is Vitro Investigation

- What Is Post Indictment Arraignment

- Mlb Opening Day 2023 Scores

- Stones River Shooting Range Nashville Tn

- What Is Federal Indictment

- What Is Investigation Hold

- What Is Indictment With Trn

- How Does An Indictment Work

-

▼

April

(59)

Total Pageviews

Search This Blog

Popular Posts

-

Cara tanam ros, cara tanam lada, cara tanam padi, cara tanam ubi, cara tanak pulut, cara tanam bendi, cara tanam buluh, cara tanam cabe, car...

-

Avengers endgame zemo, avengers endgame x men, avengers endgame x man trailer, avengers endgame embargo, avengers endgame emagine, avengers ...

-

Motif stiker mobil, motif sticker, modify stryker 655 for cb, Modif Stiker Pada Motor Mio Modifikasi Klop Otokrum via otokrum.blogspot.co...